Past performance is no guarantee of future results, especially in these complex times. However, data gives an overview at a special moment, in a given environment, and they may help us build strategies for the future.

In this edition, we would like to share some interesting data on the Spanish housing market, up to the end of 2019, in light of recent figures published by the Spanish notaries regarding foreign buyers in the 2nd semester of 2019 (private properties). We will focus on purchases numbers and purchases prices of the main foreign nationalities over last two years.

As we wrote in the first edition of the IB News, there are various sources of data on the Spanish market. The advantage of the notaries figures is that they reflect the transactions exactly in the period in which they occur, as they are registered in the month of the sale.

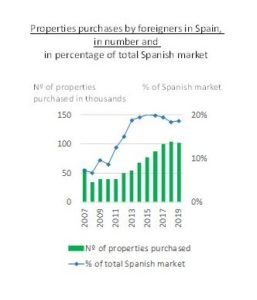

One in five transactions in Spain are made by foreign buyers

Let’s start with a global overview of the market.

Let’s start with a global overview of the market.

Foreign buyers are very important to the Spanish market as they have represented approximately one in five transactions since 2013, 19% in 2019.

In numbers, this translates to more than 100.000 transactions each year since 2017, and over 102.000 in 2019.

Their importance is especially strong in the Mediterranean coastal areas (the Valencian Community, Andalusia, Catalonia, the Region of Murcia) and in the Islands (Canary and Balearic Islands) as 80% of such acquisitions occur in these regions, whereby 60% of total purchases in Spain also occur in these popular regions. The metropolitan area of the Spanish Capital City, Madrid, is also attracting international buyers, and almost 10% of all foreign buyer purchases in 2019 took place in the Madrid region.

Foreign buyers are mostly Europeans, investing in higher value properties

In 2019, more than two thirds of foreign buyers were Europeans, including European Union nationals and the British. Spain is only a 2 to 4 hours flight for most of them …

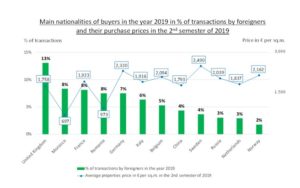

Despite Brexit, Brits remain number one investors, with 13% of total foreign purchases. Then, are the Moroccans, the French and the Romanians: 8% each, Germans: 7%, Italians: 6%, Belgians: 5%, Chinese and Swedish: 4%, Russian and Dutch: 3%, Norwegians: 2%, etc … These 12 nationalities are the main buyers and account for 72% of foreign buyers.

The properties bought by foreign buyers tend to be in a higher price bracket. In the 2nd semester of 2019, their average price was € 1,801 per sq.m, while the average for national purchases was at € 1,451 per sq.m.

Looking at the 12 main nationalities that buy here, those who tend to choose the most exclusive properties (exceeding € 2,000 per sq.m average) are the Swedish: € 2,490 per sq.m, the Germans: € 2,320 per sq.m and the Norwegians: € 2,162 per sq.m.

For properties ranging between € 1,750 and € 2,000 per sq.m , the French lead with an average of € 1,923 per sq.m, followed by Italians at € 1,916 per sq.m, the Dutch with € 1,837 per sq.m, the Chinese at € 1,793 per sq.m and the Brits: € 1,758 per sq.m.

At the other end of the scale, for properties with a value of under € 1,000 per sq.m, we see the Romanians buying at an average of € 973 per sq.m and the Moroccans at € 697 per sq.m. The profile of these 2 nationalities differ from the other ones in our sample, as they generally refer to economic migrants.

2019, a year of contrasts

2019 was a record year for tourism in Spain, with 84 million international

tourists, 1% more than the previous year. Just behind France, Spain remains the 2nd most visited country in the world.

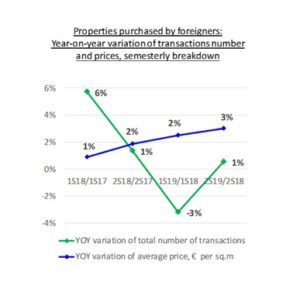

The situation in 2019 was slightly different if we focus on housing purchases, as 2019 registered a decrease of 1%, the first decrease since 2011… A reason to worry?

A semesterly breakdown of 2018 and 2019, gives a better perspective.

A semesterly breakdown of 2018 and 2019, gives a better perspective.

The pace of growth had slowed down over 2018, first by 6% and then by 1% on a yearly basis. Continuing this trajectory, the 1st semester of 2019 bottomed down, decreasing by 3 %.

But then, the second semester of 2019 gives a more positive perspective, as purchases number recovered by 1%.

Moreover, property prices support this change of direction: their pace of growth is accelerating since the first semester of 2018, from 1% to 3%.

A growth comeback…… for all nationalities?

Prices and purchases numbers are usually linked, prices movements generally anticipate transactions trends. Let’s have a look at the price variations paid by foreigners.

In order to have a homogeneous price group, we will exclude Moroccans and Romanians of our sample.

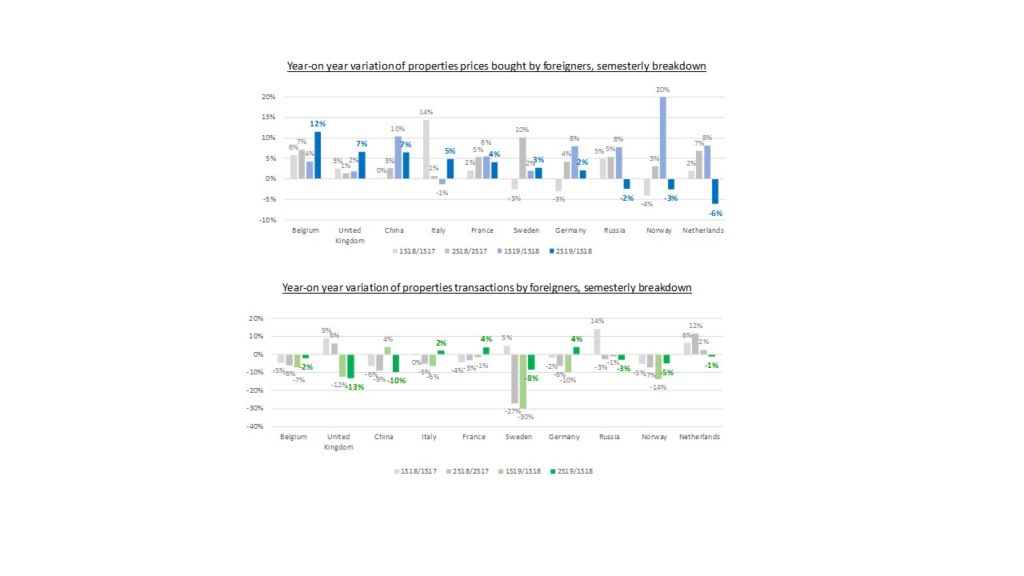

The overall picture is pretty good: purchase prices have increased for all nationalities over the last 2 years. Looking deeper in semesterly activity, one can see some irregularities.

For most of the nationalities, 7 out of 10, the 2nd semester of 2019 is a semester of rise, ranging from 2% for Germans to 12% for Belgians. Along with this positive movement, transactions trends are improving:

- Italians, French and Germans buy more, between 2% and 4%

- Belgians and Swedish buy less but the pace of reduction has reduced compared with the 1st semester of 2019, at -2% and -8% respectively. Brits have recently underperformed also, but the pace of decrease has stabilized at around -13%.

- Chinese buy 10% less properties, possibly reflecting a re-balancing after the 4% rise in the 1st

For Russians, Norwegians and Dutch, the situation is slightly different. The prices rose greatly in the 1st semester of 2019, ranging from 8% to 20%, before a decrease in the 2nd semester of 2019, inferior in absolute value, ranging from -6% to -2%. Transactions trends are heterogeneous:

- Reduction of the pace of decrease for the Norwegians, at – 5%

- First negative semester for the Dutch in the last two years, by 1%

- Third negative semester for Russians, at -3%

What’s next?

By the end of 2019, foreigners still purchase at prices below their historic high, -18% while comparing the 2nd semester of 2019 to the first semester of 2008.

By the end of 2019, foreigners still purchase at prices below their historic high, -18% while comparing the 2nd semester of 2019 to the first semester of 2008.

Of course, each nationality has its own dynamic. Germans and Belgians pay the same prices as they did more than 10 years ago, respectively -2% y and +1% compared with their highest levels, on semesterly values; while Norwegians, Dutch, Chinese, British, French, Italians and Russians still pay significantly lower prices, ranging from -17% for Norwegians to -28% for Russians.

They all have their local preferences, with a great impact on local prices. The Balearic Islands are the most expensive place for foreigners: € 3,174 per sq.m. in the 2nd semester of 2019. They are also the region that get closest to its highest level, with average prices standing just 6 % below the values seen in the peak, driven by German influence. In the Balearic Islands, Germans represent 38% of foreign buyers in 2019, English buyers being far behind with 14%.

At the opposite end is the Murcia Region. Within the Mediterranean coasts and the islands, it is the cheapest area for foreigners, at an average of € 1,015 per sq.m, a price 53% below its peak. The main nationalities buying here in 2019 were the British, who represented 33% and the Belgians at 7%.

Indeed, Spain offers an ample spectrum of reasonable prices….

Could months of lockdown reinforce the renewed appeal of foreign buyers for Spain? As the Spanish say : “Quizás, quizás, quizás…” (Perhaps, Perhaps, Perhaps as the English version of the song says!). And perhaps the digital nomad now remotely working will be key in boosting traditional foreign demand.